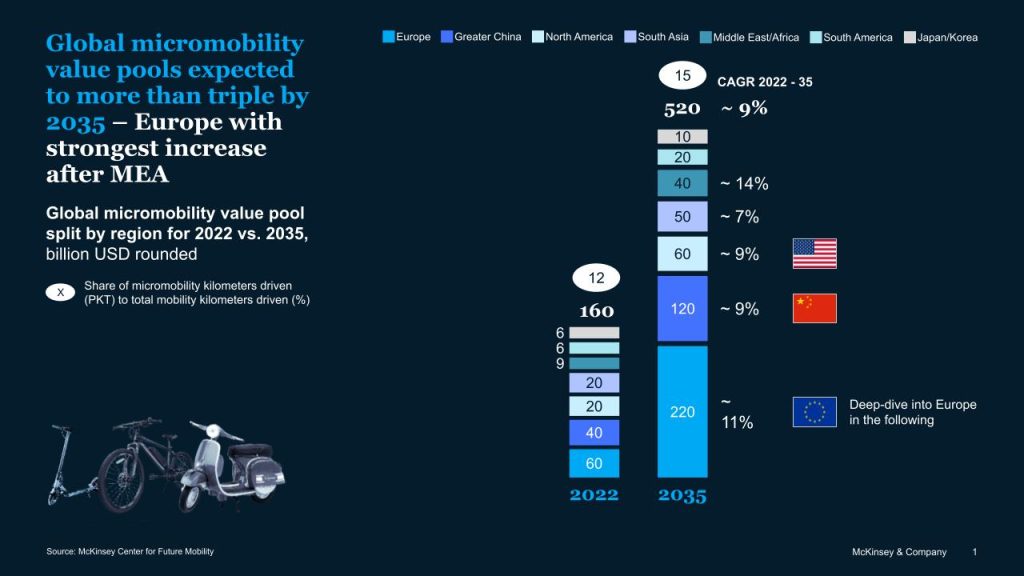

The global micromobility market is expected to reach $520 billion by 2035, McKinsey has exclusively told Zag Daily.

This is up $360 billion from today’s value and $180 billion from McKinsey’s prediction for 2030.

McKinsey’s findings are revealed one day before Associate Partner Anja Huber and Expert Darius Scurtu host the panel ‘McKinsey’s Latest Micromobility Market Sizing and Consumer Insights’ at the Micromobility Europe expo in Amsterdam.

“The main underlying drivers for our predictions on the global micromobility market are regulation and consumer behaviour,” Darius Scurtu from the McKinsey Center for Future Mobility told Zag.

“We expect that cities and countries will continue to support micromobility to reach their climate targets as one of many “sustainable” modes, and thus further invest in micromobility infrastructure, provide purchase subsidies, or partner with private micromobility operators.

“We also see rising consumer interest to integrate micromobility into their everyday lives, since modes such as e-bikes allow for longer trips and more use cases, and since micromobility will often become the cheaper and more convenient mode of travel compared to private cars, particularly in inner cities.”

The top five countries in Europe account for almost 50% of the European micromobility market today with a combined value pool of $29 billion. Of those leading markets, Germany is ranked first, France second, and the UK third.

Value pools are defined as one-time vehicle sales plus all the downstream revenues such as aftermarket services, maintenance or connectivity services.

“The main reason behind these leading markets is their comparatively large population size paired with high prices for privately bought micromobility vehicles and a relatively high saturation of bicycles per capita when comparing to Central and Eastern European countries for example.”

McKinsey adds in the caveat that market consolidation is to be expected over the next three years, with market uptake expected to be more sluggish than initially forecasted.

“Although we still believe in the long-term market potential of micromobility, we also see a current market slowdown which is fostered by a shortage in consumer demand.”

The appetite for e-bikes

McKinsey also found that e-bikes account for nearly 40% of the total micromobility market in Europe today.

E-bikes are worth approximately $22 billion in value pools and are expected to increase by 13% per annum to reach $110 billion by 2035.

Furthermore, customers are willing to spend around 9% more on their next bicycle purchase which is partly driven by the growing adoption of e-bikes and increasing prices.

“E-bike serve a broad range of use cases in a relatively effortless way and are therefore more attractive to consumers compared with a conventional bike or other micromobility modes,” Darius said.

“In our latest Mobility Consumer Survey from 2024, we found that 52% of global e-bike owners use their vehicle for everyday use versus only 34% to exercise. This makes the e-bike regularly voted as the most preferred micromobility mode amongst global consumers in our annual Mobility Consumer Survey, which we will demonstrate in our presentation at Micromobility Europe.”

Darius and Anja will be sharing their perspectives on the current market situation, as well as a deep-dive on Europe and their latest Bicycle Consumer Survey 2024.