The e-bike that disrupted the industry with their D2C (Direct-to-Consumer) approach after raising 200 million in VC funds is now selling itself for parts. As industry leaders are speaking out about the fall of e-mobility giant VanMoof, many are speculating what went wrong and what comes next.

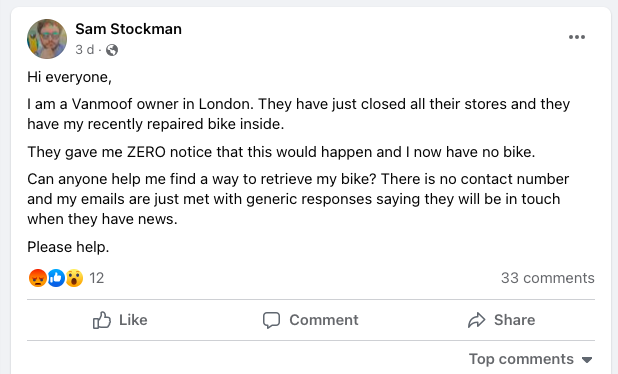

In light of the recent news, Facebook group “VanMoof Addicts Forum” more closely resembles a support group for angry customers struggling to understand what will become of their 4000 euro e-bikes. One user divulges their frustration after having in-store repairs done for a bike that is now trapped inside a likely permanently closed VanMoof store.

The custom design and proprietary parts that make the bike so sleek also mean that not just anyone can repair it. In fact, another Facebook user suggests the riders come together to make their own online repair guide while yet others offer up their own repair services for a price.

“Seeing VanMoof’s demise is disheartening. Their team’s inspiration led the industry to rethink e-bike design and prioritise customer-focused services,” Augustin Friedel, leading industry expert and advisor, tells Zag Daily. “The repercussions of VanMoof’s downfall could affect other D2C-focused players like Cake or Cowboy. To persevere, a robust strategy and action plans are imperative. With retail prices under pressure and securing additional funding appearing unlikely, resilience and innovation become paramount.”

The decline of its innovative customer-focused services may have been the nail in the coffin for VanMoof. The e-mobility landscape has changed since its entry to the market in 2009. With the boom in the industry brought on by COVID, consumers have more options to compare to and demand better service from both established manufacturers and newcomers alike.

“The VanMoof case shows that a proprietary-parts-only approach on product level, needs a solid omnichannel sales and service strategy,” Bastian Dietz, Advisory Board Member of Cycling Innovation Accelerator, tells Zag Daily.

Dietz believes VanMoof crucially failed to consider the whole customer journey, “To go global, fast, while D2C-only, without initially considering how their products could be serviced in the markets they serve was an enormous failure. In the e-bike business, you always have to consider the after-sales aspect, build regional service networks, and keep the whole customer journey in mind, until the very end.”

Prabin Joel Jones, Founder and CEO of Mayten, a management and tech consulting firm, tells Zag Daily, “It takes a lot of courage to build a hardware company in Europe. Though it is sad to see VanMoof perish, they’ve built a massive global brand and a product that challenged the status quo which is the existing bike supply chain. We need more such brave experiments in Europe and I hope at least some of the VanMoof employees would move on to create more hardware companies.”

If any ex-employees do go on to build their own companies, they have a lot to learn from the failures of VanMoof.

Its initiatives to establish retail and service partnerships came on too late leading to challenges due to a lack of wider regional service coverage. Without this, the bikes were virtually unrepairable unless near a VanMoof retail store with extremely limited customisation.

Industry insiders reflect that companies should rather prioritise making their product standards compatible and utilising established e-Ingredient brands. By doing so, they can ensure that their bikes are repairable through existing retailers and service providers, while also enabling DIY repairs and versatility.

Competitors of VanMoof have been closely observing the unfolding story. Cowboy has built an app so that VanMoof users can maintain their unique digital key, while Dance is offering VanMoof customers a discount on its service. As the e-bike market continues to mature, it’s leading to an inevitable consolidation and there is no shortage of other manufacturers ready to seize this opportunity.