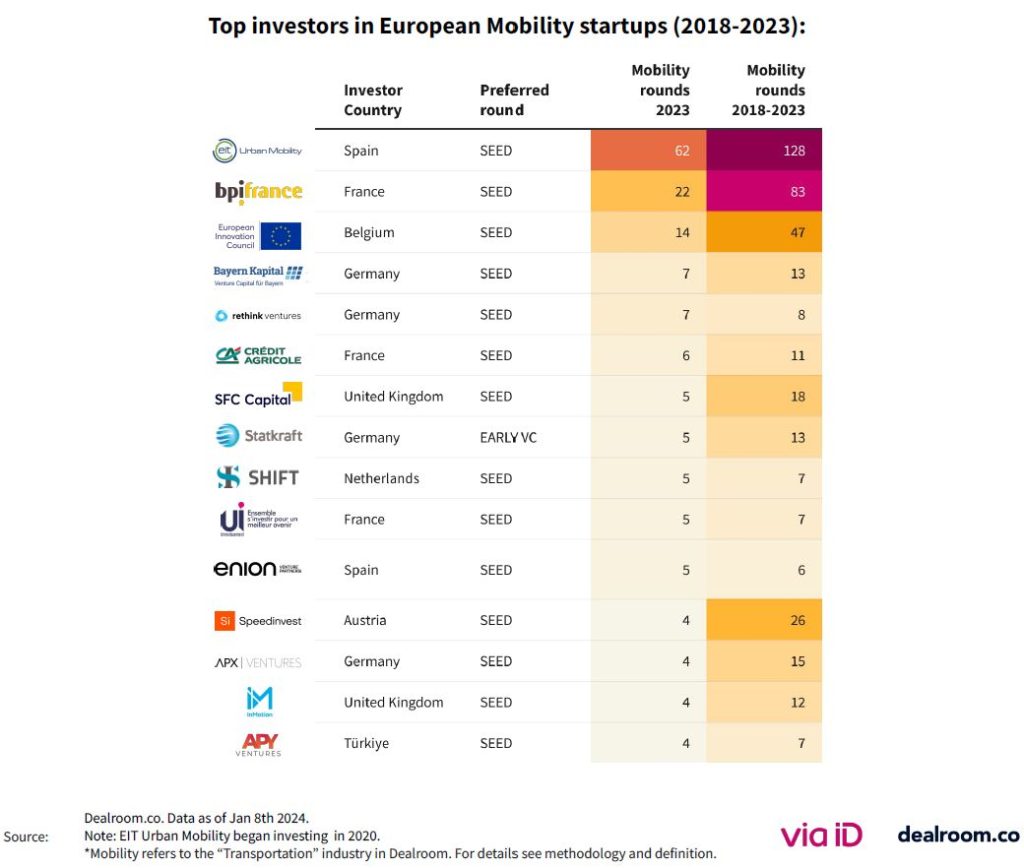

EIT Urban Mobility, Bpifrance, and the European Innovation Council have ranked as the top three investors in European Mobility startups respectively between 2018 and 2023 in a new report by Via ID and Dealroom.co.

Titled ‘State of European Mobility Startups 2023’, the report examines the European mobility startup fundraising scene against the backdrop of a globally declining venture capital market.

It found that in 2023 European mobility startups secured $9 billion in funding, marking a 26% drop from 2022.

However, the mobility sector still ranked third among the most funded industries in Europe, sending a signal of strength from the industry.

“We have invested in more than 100 startups in 1000 days,” EIT Urban Mobility’s Director of Impact Ventures Fredrik Hanell told Zag Daily.

EIT Urban Mobility, an initiative of the European Institute of Innovation and Technology (EIT), believes the reasons for the dip in funding in 2023 are multifaceted. They include market saturation, investor caution after a rapid post-pandemic expansion, macroeconomic uncertainties, regulatory challenges surrounding micromobility, and shifting consumer preferences may have contributed to a decline in investor confidence.

Nevertheless, EIT is continuing to push forward with its investment in the sector.

“Cities are looking for these solutions that bring a positive impact,” said Hanell. “By leveraging emerging technologies, forging strategic partnerships, and addressing evolving consumer needs, mobility startups can position themselves for success in an increasingly competitive landscape that goes beyond Europe. We believe this is where the landscape for mobility is going.”

Breaking the sector down

One area that shone in particular in 2023 was e-mobility companies focused on infrastructure, EV batteries and EV charging. These startups were the primary recipients of mobility funding and secured over half of the total investment.

Fredrik anticipates that startups with alternative mobility focuses will see more popularity this year.

“Startups focusing on electric two-wheelers, e-motorcycles, and e-scooters are poised to attract attention as micromobility solutions continue to gain traction,” he said. “And following this logic, in 2024 I believe that initiatives aimed at extending battery life, especially of light vehicles, promoting battery swapping, and enhancing sustainability are likely to drive investment.

“Looking ahead, the future of mobility startups in Europe will likely be shaped by several key factors. The continued growth of electric vehicles, advancements in autonomous technology, and the rise of shared mobility services are expected to drive innovation and investment in the sector.”