The global moped sharing market is 97% electric, according to a new annual report by mobility tech firm Invers.

There are now 130,000 shared mopeds globally and more than 17 million registered users, an increase of 40% since 2021.

These insights come from Invers annual Global Moped Sharing Market Report which maps out the entire industry. The authors use public data, direct contacts among 94 worldwide moped sharing operators as well as interviews to determine how demand and supply has shaped the market today.

In the last year, the number of cities in which moped sharing is offered has increased by 25% to more than 220, while the number of operators of moped sharing services increased by 8% to 94 providers.

“We see that all major KPIs including the number of mopeds, registered users, countries and cities continue to grow,” Invers Senior Market Researcher and co-author of the report, Enrico Howe, told Zag Daily. “But most exciting of all is that we are looking at an almost entirely electric market. Also the Indian moped sharing market, which is one of the last markets where we see combustion mopeds, will in the near future be 100% electric.”

Mapping global moped sharing

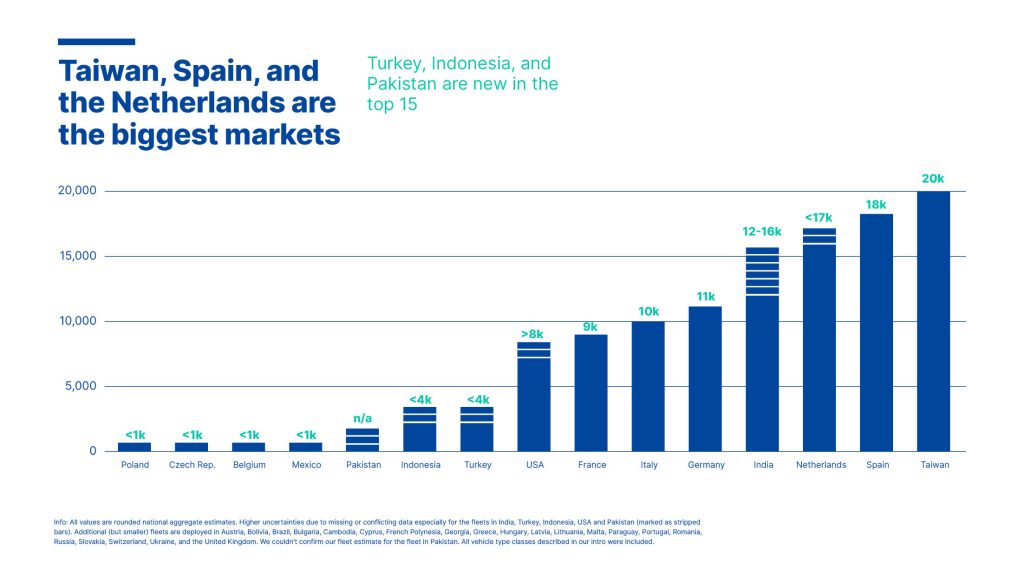

Taiwan, Spain and the Netherlands are the top three largest markets for shared mopeds respectively.

With a population of around 24 million, Taiwan has the biggest moped sharing fleet globally with almost 20,000 vehicles.

Europe has been the dominant moped-sharing market for many years and 55% of the global fleet is still located there.

“Europe itself is the leader in moped sharing,” said Howe. “More than every second shared moped comes from Europe.”

But more non-European countries have reported bigger fleet sizes over the last 12 months, including India, Indonesia, and Taiwan.

Five new countries have entered the moped sharing space – Bolivia, Greece, Paraguay, Turkey and the UK.

Key trends

This year Invers saw the continued emergence of a new form factor it dubs ‘moped/bike hybrids’. Having identified more than 20,000 such vehicles (16%) this year, the category sits in a grey zone between mopeds and e-bikes. Five examples of this form factor come from Yulu, Migo, Veo, Lime and Marti.

The rest of the vehicles are mostly L1-class mopeds (75%) while 9% are L-3 class motorcycles. One of the major differences in these form factors is vehicle speed. Mopeds can often reach speeds of around 45 km/h, motorcycles are faster, while moped/bike hybrids typically go around 25-35 km/h.

When it comes to service providers, some takeovers and a significant market concentration can be observed in the industry. For example, Emmy was bought by GoTo in 2021 and GO Sharing acquired Italian operator ZigZag at the end of last year. The report shows that the top 10 operators now own and run 60% of the global fleet of shared mopeds.

Other key trends include multimodality where a shared operator launches a number of vehicle types within its fleet; diversification where operators adapt their core business models with for instance subscriptions or long-term rentals; and finally there has been increased interest from operators offering dedicated delivery businesses.

2023 predictions

Moped sharing is now an established form factor. “It is here to stay,” said Howe.

A key prediction is that moped sharing will continue to become less European dominated and more global. This year saw the number of moped sharing countries rise from 27 to 36. “We’re also curious how the economic crisis will impact the shared mobility market in the coming years,” said Howe. “We predict some acquisitions in 2023 as a result. But what I can say is that throughout the 10 year existence of moped sharing we’ve just seen year-on-year growth.”