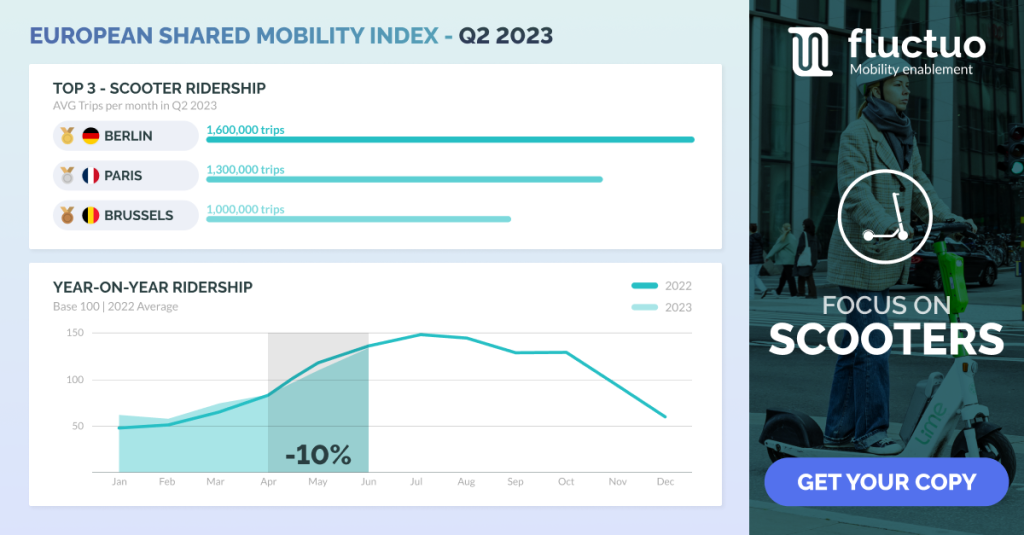

After four consecutive years of e-scooter growth, ridership has declined by 10% for the first time according to Fluctuo’s latest Q2 2023 European Shared Mobility Index.

The ridership decline is attributed to a combination of factors, including over-saturation in less regulated markets and the implementation of more stringent regulations around parking, speed limits, and deployment areas in other markets.

Two of the top three cities for scooter ridership, Paris and Brussels, are overhauling their shared mobility markets. Operators in Paris removed 15,000 scooters from the streets in September and Brussels will cut its scooter fleets from 20,000 to 8,000 in January.

With the two cities representing a total combined market share of 18% of all scooter trips, Fluctuo predicts that the scooter ridership will continue to decline in 2023 and 2024. In the midst of market uncertainty, Bordeaux stands out as a success story and sees its ridership quadruple.

Despite the drop, scooters still make up 52% of shared vehicles and 42% of all shared mobility journeys this last quarter across the 33 cities analysed.

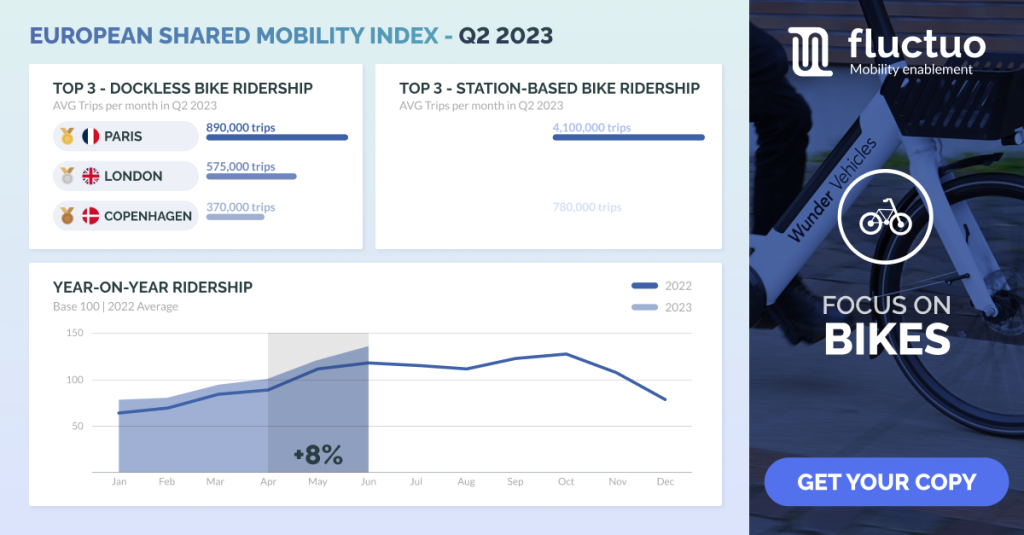

The report reveals that the shared mobility market is diversifying after a period of domination by scooters.

Because of stricter regulations, tender requirements and market saturation, operators are shifting back to bikes, with both free-floating and station-based services gaining traction.

This has meant station-based bike usage is up 8%, while dockless bike ridership is up 24%.

In one year, we have seen the introduction of 30,000+ free-floating bikes.

“What we’re seeing is that major European cities that had 10,000+ scooters (Stockholm, Oslo, Helsinki and, most recently, Brussels) have reduced that to around 6-8,000,” Fluctuo CEO Julien Chamussy told Zag Daily.

“The demand far outweighs the supply at this level, but cities want to encourage the use of bikes too. For example, Brussels new tender shows they want to bring in three operators to supply a total of 7,500 dockless bikes to counter-balance the reduction of 12,000 scooters.”

Shared cars prove to be the fastest growing mode in Europe this quarter (+14%).

Overall the market continues to grow with a 7% increase in fleet sizes.

The European Shared Mobility Index provides a quarterly snapshot of the market across an analysis of 33 European cities selected to showcase diversity in terms of size, geography, and market characteristics, and encompasses shared bikes, scooters, mopeds and cars, excluding ride-hailing services, car-pooling and long-term rental.