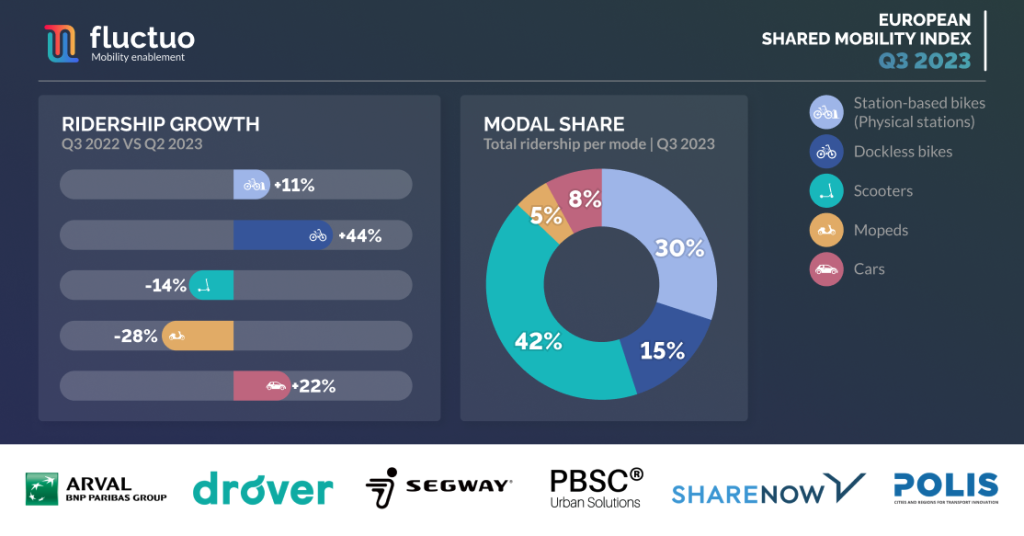

Ridership of dockless bikes across Europe has increased by 44% in Q3 2023, according to Fluctuo’s latest European Shared Mobility Index report.

Dockless bike fleets have grown 12% since last year. There are now 90,000 dockless bikes in total which nearly matches the 100,000 station-based bikes dotted across the 33 cities considered in the report.

Fluctuo CEO Julien Chamussy told Zag Daily that the last 12 months have seen a shift in how operators have advocated for dockless bikes.

“A year ago, scooter operators were still reluctant to push dockless bikes because the unit economics are not as good as they are for scooters – bikes are more expensive to purchase and more difficult to operate.

“This has changed. In some cases, it was because the city gave them no choice if they wanted to stay in the city. Take Paris, for example.”

Indeed, dockless bike ridership doubled in Paris in September 2023 – the first month the French capital’s e-scooter ban took effect. Meanwhile scooters saw a ridership reduction of 14% across Europe since this time last year.

At 1.4 million trips, Paris saw the second-highest average number of trips taken per month by dockless bike in Q3 2023. At 3.9 million trips, it ranked first for the number of trips taken by station-based bikes.

“When it comes to transport, Paris has been one of the most forward-thinking cities over the last 5 to10 years and despite the recent scooter ban the city is dead-set on reducing private car use,” Julien said.

“Operators Dott, Lime and Tier have been asked to remove all their scooters by the end of August but, at the same time, they have been encouraged to double down on dockless bikes. The fleet of dockless bikes has reached 18,000 vehicles, which is almost the size of Velib’, the official station-based bike-sharing scheme.”

“The 2024 Olympic Games take place next year, and with the difficulties they are facing in ramping up the Vélib’ service, Paris will definitely count on these dockless bikes to enable athletes, delegates and tourists to move throughout the city.

“Parisians are no strangers to bikes, and their success is ensured for the foreseeable future.”

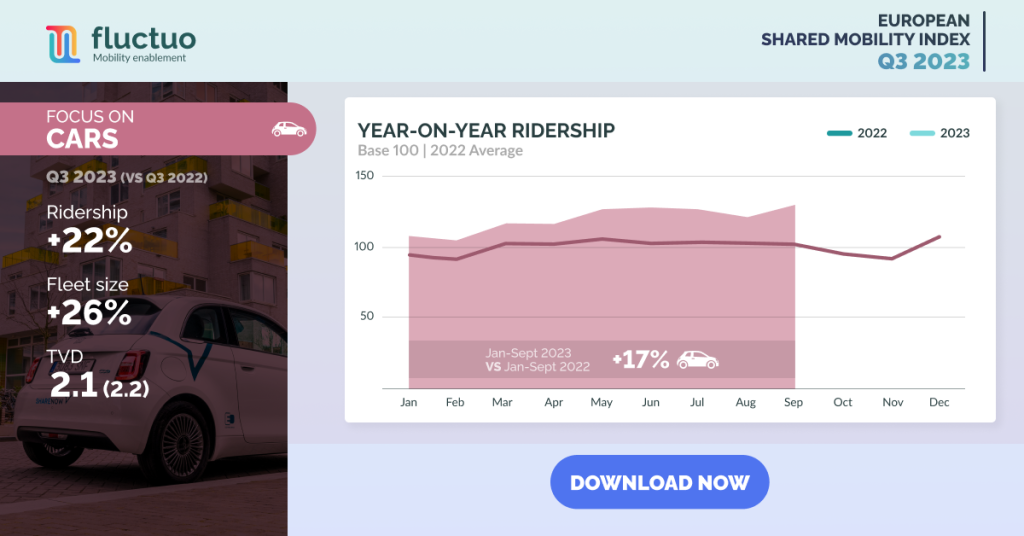

Shared car ridership

“What surprised us most was the continued growth of shared car fleets and their ridership,” Julien said. “For the other modes, we were just confirming what a lot of us thought.”

Over the last 12 months shared car ridership grew by 22% with Berlin and Hamburg boasting the top average trips per month at 600,000 and 350,000 trips respectively.

While German cities continue to dominate the rankings, Madrid ranked the third highest for shared car trips at 325,000 per month.

“Shared cars have struggled to grow beyond Germany and some other major cities in the past – but we are now seeing that the demand is there, and that their popularity will improve as long as the right incentives are brought in for users and operators,” Julien said.

Examples of these incentives include free parking for shared electric cars in Madrid, and elevated parking fees for private car parking in city centres.

Julien also looks to the next quarter for micromobility.

“Winter is always an uncertain time for operators. Some services go into hibernation, rides drop, and revenue decreases. The financial uncertainty surrounding some operators will become more apparent, and this is when we expect the market consolidation process to accelerate.”

Julien’s eye is now firmly on Brussels which recently saw a tender to reduce the number of e-scooters in the Belgian capital’s over-saturated market.

“What is certain is that we expect ridership to be consistent with last year in most cities, save the ones that have had shake-ups due to fleet reductions like Rome and Helsinki. Everyone is watching Brussels. That tender is now of significant importance for scooter operators after the ban in Paris.”