Japanese micromobility operator Luup has raised approximately £26 million in funding to expand its micromobility stations and improve its vehicles and app.

Luup’s mission is to create an infrastructure that makes the entire city ‘a station front’ where users can borrow and return micromobility vehicles.

Since the launch of the e-scooter business in April 2021, Luup has built more than 3,000 such stations across Tokyo, Osaka, Kyoto, Yokohama, Utsunomiya and Kobe.

The idea is to transform office buildings, condominiums, storefronts and small open spaces into transportation hubs.

Zag spoke with Daiki Okai, CEO of Luup, who said: “Historically, cities in Japan have developed alongside major train stations which resulted in disparity of convenience as well as real estate value, depending on the distance from the train station.

“Making the entire city ‘a station front’ means that we aim to create our network at a very high density so that even people living far from train stations can move freely from Luup stations, hopefully filling the gap of convenience and real estate value between those close to the train stations and those that are not.”

With a target to operate more than 10,000 stations by 2025, Luup will expand its business not only to urban centres but also rural areas.

Both Luup’s e-scooters and e-bikes are available at these stations. “We hope to introduce a new form of seated micromobility in the future to provide for the elderly and perhaps disabled people,” said Okai.

Luup is currently receiving inquiries from many property owners, municipalities and companies for the company’s station fronts.

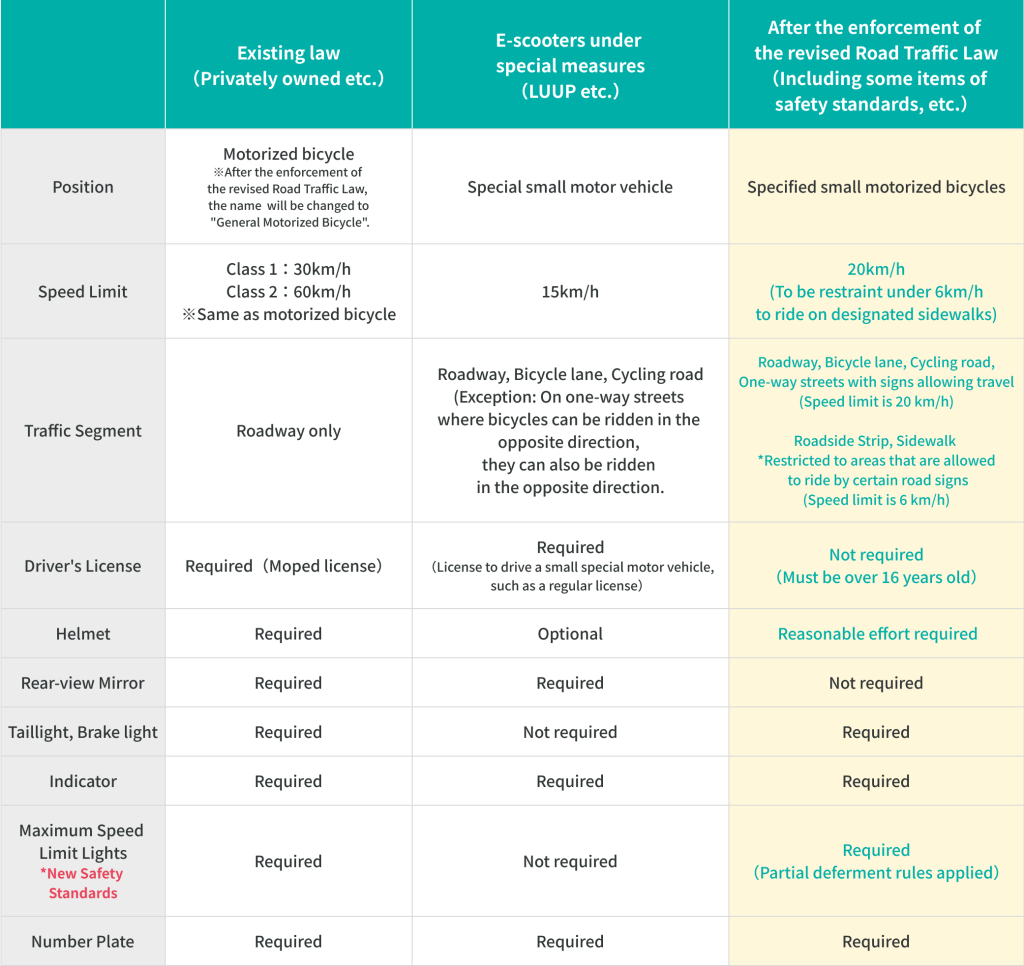

The investment comes in preparation for the enforcement of Japan’s revised Road Traffic Act in July, which is expected to boost micromobility. Changes include a new 20 km/h speed cap and the exemption of a driver’s licence.

Capital

This new round of funding brings Luup’s total capital raised to around £54 million. From the £26 million fund, approximately £22m was issued in equities and around £4m through debt and asset financing.

Spiral Capital was again the lead investor. Additional investments were made by ANRI, SMBC Venture Capital, and Mori Trust, as well as new investors including one of the largest pension funds in Japan, 31ventures, and Mitsubishi UFJ Trust and Banking Corporation.

Takashi Chiba, a Partner at Spiral Capital, said the additional investment takes into account that “Luup is a rare company that is truly trying to create a ‘social infrastructure’.

“It is no mean feat to build a service that can be called a transportation infrastructure, as it requires cooperation of numerous stakeholders, including users, landowners, local governments, relevant ministries, investors, and public opinion.

“The products have become popular among users and are used daily, leading to the company’s dominant position in the field of micromobility. With the implementation of the revised Road Traffic Law, we expect that the product will continue to evolve as a transportation infrastructure that enriches people’s daily lives.”